Your BEST source of information about the USA.

Subscribe to our content and always stay up to date with the latest news!

Stay informed with the best and most reliable news around the world !!!

Exclusive Contents For You

2026 State 529 Plans: Best Returns Comparison

Navigating the landscape of 2026 state-sponsored 529 college savings plans reveals significant variations in investment performance, tax benefits, and overall value, making careful comparison crucial for maximizing educational savings.

2026 SEC Regulations: Investment Portfolio & Compliance Guide

The 2026 SEC Regulations introduce significant changes impacting investment portfolios and compliance, necessitating proactive adjustments for both financial institutions and individual investors to maintain regulatory adherence and optimize strategies.

Veterans’ Benefits in 2026: VA Healthcare & Disability Rates Explained

This article outlines the significant changes and expansions in Veterans' Benefits in 2026, focusing on VA healthcare enhancements and new disability compensation rates to empower veterans with crucial, up-to-date information.

US Energy Policy: 50% Renewables by 2026 Goal

The US administration is targeting an ambitious 50% renewable energy consumption by 2026, a policy shift poised to redefine the nation's energy landscape and drive significant economic and environmental changes.

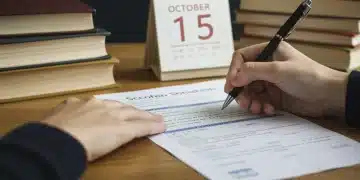

2026 National Merit Scholarships: October 15th Deadline Alert

The 2026 National Merit Scholarship application deadline is October 15th, 2025, a critical date for high school juniors aiming for prestigious college funding. Understanding eligibility and the application process is essential for prospective scholars across the U.S.

2026 Retirement Planning: Adjusting Your 401(k) for 3% Inflation

Effective 2026 retirement planning necessitates proactive adjustments to 401(k) contributions, strategically accounting for projected 3% inflation to preserve purchasing power and ensure long-term financial security.