Maximizing Unemployment Benefits in 2025: Expert Guide

Securing and extending unemployment benefits in 2025 requires proactive engagement with state guidelines, understanding eligibility, and utilizing available resources to potentially gain up to 13 additional weeks of financial assistance.

Navigating the complexities of unemployment benefits can be daunting, especially with evolving regulations. This article aims to equip you with expert insights on maximizing unemployment benefits in 2025, ensuring you understand state-specific aid and how to potentially extend your coverage by up to 13 weeks.

Understanding the Landscape of Unemployment Benefits in 2025

Unemployment benefits serve as a critical safety net for individuals who have lost their jobs through no fault of their own. As we look towards 2025, it’s crucial to recognize that while federal guidelines often set a baseline, the administration and specifics of these benefits are largely determined at the state level. This decentralized approach means that eligibility criteria, weekly benefit amounts, and the duration of benefits can vary significantly from one state to another.

Staying informed about your state’s particular rules is the cornerstone of maximizing your benefits. These rules are not static; economic conditions, legislative changes, and even federal policies can influence them. Therefore, a proactive approach to understanding these nuances is essential for any applicant.

State-Specific Eligibility Requirements

Every state has its own set of criteria that an applicant must meet to qualify for unemployment insurance. These typically revolve around your work history, earnings during a base period, and the reason for your job separation. Understanding these requirements before applying can save you time and prevent potential denials.

- Work History: Most states require a certain amount of earnings or hours worked within a specific period, usually the last 12-18 months.

- Reason for Separation: You must generally be unemployed through no fault of your own. Quitting voluntarily without good cause or being fired for misconduct typically disqualifies you.

- Availability and Search for Work: You must be able and available to work and actively seeking new employment, often requiring weekly certification of job search activities.

It is important to review your state’s Department of Labor or equivalent agency website for the most current and detailed eligibility guidelines. These resources often provide comprehensive FAQs and even online eligibility calculators.

Weekly Benefit Amounts and Duration

The amount of money you receive each week and how long you can receive it also depends on your state and your past earnings. States typically calculate your weekly benefit amount as a percentage of your average weekly wage during a base period, up to a maximum limit. The standard duration for regular unemployment benefits is often 26 weeks, but this can be shorter in some states.

Being aware of these figures will help you plan your finances more effectively while you are unemployed. Some states may offer higher maximums or longer durations based on specific economic conditions or special programs, so always check for any temporary expansions.

In conclusion, the initial step to maximizing your unemployment benefits in 2025 involves a thorough understanding of your state’s unique regulations regarding eligibility, benefit amounts, and duration. This foundational knowledge will empower you to navigate the application process more efficiently and effectively.

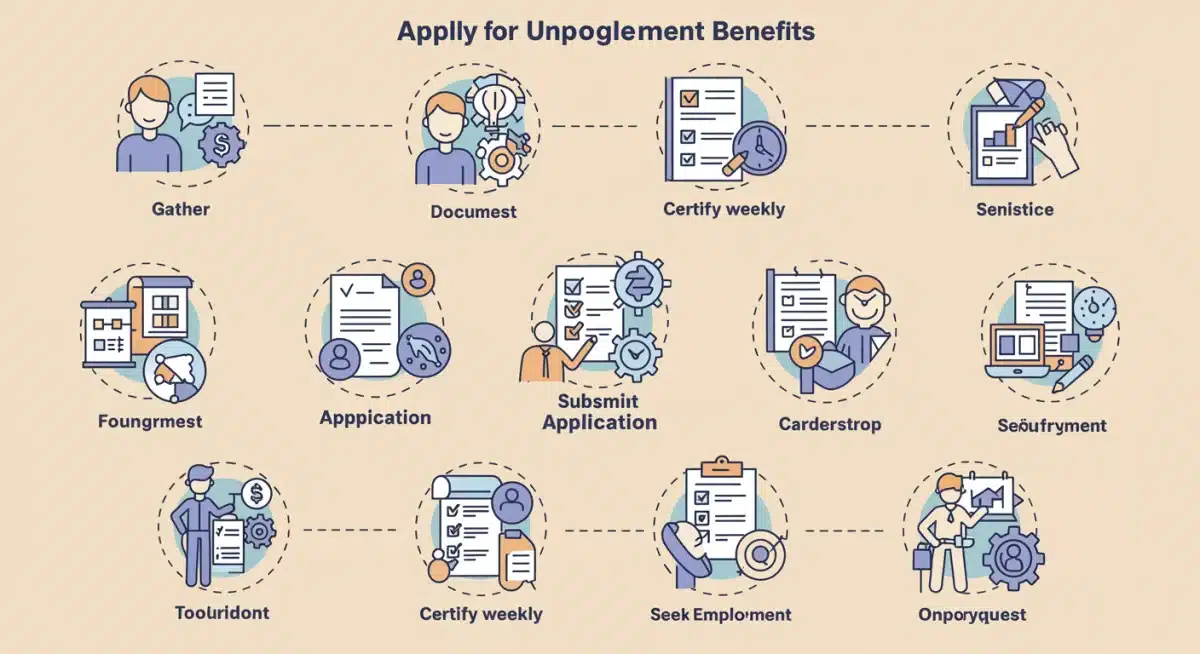

The Application Process: Essential Steps and Best Practices

Applying for unemployment benefits can seem like a bureaucratic maze, but with a structured approach, it becomes manageable. The key is to gather all necessary documentation, understand the application platform, and be meticulous with details. Errors or omissions can cause significant delays in receiving your much-needed financial support.

Proactive preparation and careful submission are crucial. Many states now offer online application portals, which can streamline the process, but they still require accurate and complete information.

Gathering Required Documentation

Before you even begin the application, compile all the necessary documents. This preparation will ensure a smooth and quick submission process, reducing the chances of follow-up requests for information that could delay your claim.

- Personal Identification: Social Security Number (SSN), driver’s license or state ID.

- Employment History: Names, addresses, and phone numbers of all employers for the past 18-24 months, including dates of employment and reasons for separation.

- Wage Information: Pay stubs, W-2 forms, or other proof of earnings from your previous employers.

- Separation Details: Any termination letters, severance agreements, or other documents related to your job loss.

Having these documents readily available will not only expedite your initial application but also assist in any appeals or clarification requests that might arise.

Navigating the Online Portal and Avoiding Common Pitfalls

Most states encourage or even require online applications. While convenient, these portals demand precision. Read all instructions carefully and double-check every entry before submitting. Common pitfalls include typographical errors, incorrect dates, or misinterpreting questions.

It’s advisable to complete the application in one sitting if possible, to maintain continuity and accuracy. If you must pause, ensure you save your progress correctly. Many states also offer help lines or online chat support if you encounter technical issues or have questions about specific fields.

Certifying Weekly Benefits and Job Search Requirements

Once your application is approved, the process doesn’t end. You will typically need to certify your eligibility weekly or bi-weekly. This involves confirming that you are still unemployed, able and available for work, and actively searching for a job. Failing to certify or inaccurately reporting your job search activities can lead to a suspension or termination of benefits.

Maintain a detailed record of your job search efforts, including dates, company names, contact persons, and results. This documentation will be invaluable if your claim is ever audited or questioned. Understanding and adhering to these ongoing requirements is just as important as the initial application for maximizing your unemployment benefits in 2025.

In summary, a successful unemployment claim in 2025 hinges on meticulous preparation, accurate submission of your application, and consistent adherence to weekly certification and job search mandates. These best practices significantly increase your chances of receiving and maintaining your benefits without interruption.

Extending Coverage: Strategies for Up to 13 Additional Weeks

While standard unemployment benefits provide crucial temporary relief, they often have a fixed duration, typically 26 weeks. However, under certain circumstances, it is possible to extend this coverage, potentially securing up to 13 additional weeks of financial support. These extensions are not automatic and usually depend on specific economic triggers or federal programs.

Understanding these potential avenues for extension is vital for anyone who anticipates needing prolonged assistance. Proactive research and timely action are key to accessing these additional weeks.

Understanding Extended Benefits (EB) Programs

Extended Benefits (EB) programs are a federal-state program that provides additional weeks of unemployment compensation during periods of high unemployment. These programs are triggered when a state’s insured unemployment rate reaches a certain threshold. The duration of EB can vary, often providing an additional 13 weeks of benefits once regular state benefits are exhausted.

It’s important to monitor your state’s unemployment rate and announcements from your state’s Department of Labor to determine if EB programs are active. Eligibility for EB usually mirrors that of regular benefits, meaning you must still be able and available for work and actively seeking employment.

Federal Extension Programs and Disaster Unemployment Assistance

Beyond state-triggered EB, federal legislation can sometimes introduce temporary unemployment extensions during national economic crises or emergencies. While not consistently available, past years have seen federal programs offering significant additional weeks of benefits. Staying informed about federal legislative developments is crucial.

Additionally, Disaster Unemployment Assistance (DUA) is a separate federal program that provides financial assistance to individuals whose employment or self-employment has been lost or interrupted as a direct result of a major disaster declared by the President. DUA is available to individuals who are not eligible for regular unemployment insurance benefits. This program is highly specific and only applies to declared disaster areas.

Proactive Steps for Seeking Extensions

To maximize your chances of receiving extended benefits, proactive engagement is essential. This includes:

- Monitoring State and Federal Announcements: Regularly check your state’s unemployment agency website and federal labor department news for updates on extended benefit programs.

- Maintaining Eligibility: Continue to meet all job search and weekly certification requirements, even as your regular benefits near exhaustion.

- Contacting Your State Agency: If you believe you might be eligible for an extension, reach out to your state’s unemployment office for guidance on how to apply or what steps to take.

Many extensions are not automatically granted; you may need to apply specifically for them. Therefore, being informed and taking timely action is paramount to securing up to 13 additional weeks of support.

In essence, extending your unemployment coverage in 2025 beyond the standard period requires vigilance and an understanding of both state-triggered Extended Benefits and potential federal programs. By staying informed and proactive, you can significantly enhance your financial safety net during periods of prolonged unemployment.

Navigating State-Specific Aid: What to Expect in Different Regions

The United States’ unemployment insurance system is a mosaic of state-administered programs, each with its own nuances. While federal law sets broad guidelines, the specifics of aid—from eligibility to benefit amounts and duration—are largely determined by individual states. This means that an applicant in California might experience a vastly different process and outcome than someone in Texas or New York.

Understanding these regional variations is not just about knowing the rules; it’s about anticipating the journey and tailoring your approach to your specific locale. This section delves into the general differences you might encounter across various states.

Variations in Benefit Amounts and Duration

One of the most noticeable differences between states is the weekly benefit amount (WBA) and the maximum duration of benefits. States calculate WBA based on a percentage of a claimant’s past earnings, but the maximum cap varies widely. For example, a high-wage earner in a state with a low maximum WBA might receive a smaller percentage of their former income compared to someone in a state with a higher cap.

Similarly, while 26 weeks is a common maximum duration for regular benefits, some states offer fewer weeks (e.g., Florida offers 12 weeks, North Carolina offers up to 20 weeks depending on the state’s unemployment rate), and others might offer slightly more under specific conditions. These variations directly impact the financial stability of unemployed individuals.

Distinct Eligibility Rules and Application Processes

Beyond financial figures, states also implement their own interpretations of eligibility criteria. While all states require you to be unemployed through no fault of your own, the specifics of what constitutes ‘good cause’ for quitting or ‘misconduct’ for being fired can differ. Some states might have stricter definitions, making it harder to qualify in certain scenarios.

The application process itself can also vary. Some states have highly integrated online portals that guide you through each step, while others might still rely on a mix of online and paper submissions, or require more in-person interactions. Understanding your state’s specific application flow can help you prepare more effectively and avoid delays.

Job Search Requirements and Reporting

All states require claimants to be able and available for work and to actively seek employment. However, the definition of ‘actively seeking’ and the reporting requirements can vary. Some states might require a minimum number of job contacts per week, while others might be more flexible but still expect diligent effort.

- Number of Contacts: Some states mandate a specific number of employer contacts (e.g., 3-5 per week).

- Types of Contacts: Requirements might specify the types of job search activities that count (e.g., applying for jobs, attending job fairs, networking).

- Reporting Frequency: Most states require weekly certification, but the exact reporting method and deadline can differ.

Failing to meet these state-specific job search requirements is a common reason for benefit suspension, so it’s critical to be fully aware of and adhere to your local rules.

In conclusion, navigating unemployment benefits in 2025 necessitates a deep dive into your state’s particular regulations. By understanding the regional differences in benefit amounts, eligibility, application processes, and job search requirements, you can optimize your approach and maximize the support you receive.

Maximizing Your Claim: Tips for Successful Application and Appeals

A successful unemployment claim goes beyond just submitting an application; it involves strategic planning, meticulous record-keeping, and knowing how to advocate for yourself if your claim is denied. Many individuals face initial hurdles or denials, but understanding the process for appeals and having robust documentation can significantly improve your chances of success.

This section provides actionable tips to strengthen your application, prepare for potential challenges, and effectively navigate the appeals process to ensure you receive the benefits you are entitled to.

Accuracy and Completeness: The Foundation of a Strong Claim

The most fundamental tip for a successful application is to ensure absolute accuracy and completeness. Any discrepancies, missing information, or vague answers can trigger delays or outright denial. Treat the application as a formal legal document, because in essence, it is.

- Review All Information: Before submission, meticulously review every field for accuracy, especially dates, employer names, and reasons for separation.

- Provide All Requested Documentation: Do not omit any requested documents, even if you think they might not be critical. It’s better to over-provide than under-provide.

- Be Clear and Concise: When explaining your job separation or other circumstances, use clear, concise language. Avoid jargon or overly emotional statements.

A well-prepared application minimizes the need for follow-up questions from the unemployment agency, accelerating the processing of your claim.

Maintaining Detailed Records: Your Best Defense

Throughout your unemployment period, from application to receiving benefits, maintaining comprehensive records is paramount. These records serve as your evidence should any questions or disputes arise regarding your eligibility or job search efforts.

Keep a physical or digital file containing:

- Copies of your initial application and all subsequent weekly certifications.

- Correspondence with the unemployment agency (emails, letters, notes from phone calls including dates, times, and names of representatives).

- Detailed log of all job search activities (dates, company names, contact persons, positions applied for, method of application, and results).

- Any documentation related to your job separation (termination letters, severance agreements, performance reviews).

This organized approach will be invaluable if you need to appeal a decision or clarify information with the agency.

Understanding and Navigating the Appeals Process

If your claim is denied, do not despair. You have the right to appeal the decision, and many denials are overturned on appeal. The appeals process typically involves several stages, starting with a request for reconsideration and potentially leading to a hearing.

- Act Promptly: There are strict deadlines for filing an appeal, usually within a few weeks of the denial notice. Missed deadlines can forfeit your right to appeal.

- Understand the Reason for Denial: The denial notice will state the reason. Understanding this reason is crucial for preparing your appeal.

- Prepare Your Evidence: Use your detailed records to present a strong case. If there’s a hearing, be prepared to testify and present your evidence clearly.

- Seek Assistance: Consider consulting with legal aid organizations or attorneys specializing in unemployment law if your case is complex.

Successfully navigating the appeals process can mean the difference between receiving benefits and going without. Your persistence and preparation are key to maximizing your unemployment benefits in 2025.

In conclusion, maximizing your unemployment claim involves a proactive and detail-oriented approach. By ensuring accuracy in your application, maintaining meticulous records, and understanding the appeals process, you significantly enhance your ability to secure and retain your rightful benefits.

Financial Planning During Unemployment: Beyond the Benefits

While unemployment benefits provide a vital financial bridge, they are rarely sufficient to cover all living expenses, especially during extended periods of joblessness. Effective financial planning during unemployment is crucial for maintaining stability and minimizing stress. This involves more than just budgeting; it encompasses exploring additional resources, managing debt, and planning for future employment.

Adopting a comprehensive financial strategy can help you stretch your benefits further and navigate this challenging period with greater confidence.

Budgeting and Expense Reduction

The first step in financial planning is to create a realistic budget based on your unemployment income. This means meticulously tracking all income and expenses and identifying areas where you can cut back. Differentiate between essential and non-essential spending and prioritize the former.

- Track Everything: Use budgeting apps or spreadsheets to monitor every dollar in and out.

- Cut Non-Essentials: Temporarily suspend subscriptions, reduce dining out, and postpone non-critical purchases.

- Negotiate Bills: Contact utility providers, landlords, or lenders to see if temporary payment arrangements or deferrals are possible.

Even small reductions in daily spending can add up significantly over weeks and months, helping your benefits last longer.

Exploring Additional Financial Resources

Unemployment benefits are one form of support, but others might be available depending on your circumstances. Researching these options can provide additional relief and ensure you have a stronger financial safety net.

- Emergency Savings: If you have an emergency fund, now is the time to utilize it responsibly to cover essential expenses.

- Food Assistance Programs: Programs like SNAP (Supplemental Nutrition Assistance Program) can help cover grocery costs.

- Housing Assistance: Local government or non-profit organizations might offer assistance with rent or mortgage payments.

- Health Insurance: Explore options like COBRA, state marketplaces, or Medicaid to ensure continuous health coverage.

Don’t hesitate to seek out these resources; they are designed to help during times of financial hardship.

Debt Management and Credit Protection

Unemployment can make managing debt particularly challenging. Prioritize paying essential bills and minimum payments on high-interest debts. If you anticipate difficulty making payments, contact your creditors proactively.

They may be willing to offer temporary relief, such as deferrals or reduced payments. It’s also crucial to monitor your credit report during this time to ensure no errors or fraudulent activity occurs, which could further complicate your financial situation.

In conclusion, effective financial planning during unemployment extends beyond merely receiving benefits. It involves stringent budgeting, actively seeking additional financial resources, and proactive debt management. By taking these steps, you can safeguard your financial well-being and navigate the period of joblessness more securely while maximizing your unemployment benefits in 2025.

The Role of Job Search and Training in Sustaining Benefits

Receiving unemployment benefits is contingent upon actively seeking new employment. However, a successful job search in today’s dynamic market often requires more than just submitting applications. It involves strategic planning, skill development, and leveraging available resources to enhance your employability and secure a new role efficiently.

Understanding how your job search efforts directly impact your benefits and how to make those efforts more effective is crucial for sustaining your financial support and transitioning back into the workforce.

Meeting Job Search Requirements for Continued Eligibility

Every state has specific requirements for job search activities that claimants must meet to continue receiving unemployment benefits. These requirements are not merely bureaucratic hurdles; they are designed to encourage a swift return to employment. Failing to meet them can result in a suspension or termination of your benefits.

- Document Everything: Keep a meticulous log of all job applications, interviews, networking events, and career workshops attended.

- Understand Your State’s Definition of ‘Active Search’: Some states require a specific number of contacts per week, while others might accept a broader range of activities.

- Be Prepared to Provide Proof: If audited, you will need to demonstrate your job search efforts, so your records must be thorough and accurate.

Adhering to these requirements is non-negotiable for anyone looking to maximize their unemployment benefits in 2025.

Leveraging State-Sponsored Training and Reemployment Services

Many states offer free or low-cost reemployment services and training programs designed to help unemployed individuals enhance their skills and find new jobs. These resources are often underutilized but can be incredibly valuable.

These services might include:

- Career Counseling: Guidance on career paths, resume writing, and interview skills.

- Workshops and Webinars: Training on job search strategies, digital skills, and industry-specific knowledge.

- Skills Training Programs: Opportunities to acquire new certifications or skills in high-demand fields.

Participating in approved training programs can sometimes even waive certain job search requirements, allowing you to focus on skill development while still receiving benefits. Check with your state’s workforce development agency for available programs.

Networking and Professional Development

Beyond formal applications, networking plays a critical role in today’s job market. Many jobs are found through connections rather than direct applications. Actively engaging in professional networking, both online and in-person, can significantly shorten your job search.

Furthermore, continuous professional development, even when unemployed, demonstrates initiative and keeps your skills current. This could involve online courses, industry certifications, or even volunteer work that utilizes your professional skills. These activities not only improve your job prospects but also show a commitment to reemployment, which can be beneficial if your unemployment claim is ever reviewed.

In summary, the job search is an integral part of receiving unemployment benefits. By actively meeting job search requirements, utilizing state-sponsored training programs, and investing in professional development, you not only sustain your benefits but also enhance your chances of a successful and swift return to the workforce, thus maximizing your unemployment benefits in 2025.

Legal and Ethical Considerations for Unemployment Claims

While the goal is to maximize unemployment benefits, it’s equally important to navigate the system ethically and legally. Misrepresenting information or failing to report changes in your circumstances can lead to serious consequences, including benefit repayment, penalties, and even criminal charges. Understanding your responsibilities as a claimant is paramount for a smooth and lawful experience.

This section outlines key legal and ethical considerations to keep in mind throughout your unemployment claim, ensuring you remain compliant with state and federal regulations.

Accurate Reporting of Income and Work

One of the most common pitfalls for unemployment claimants is the inaccurate reporting of income or work. Even part-time or temporary work, or earnings from freelance activities, must be reported to the unemployment agency. Failure to do so can be considered fraud.

States have sophisticated systems to detect unreported earnings, often cross-referencing with employer payroll data. If you earn any income while receiving benefits, report it truthfully and promptly, even if it’s a small amount. Your weekly benefit amount will likely be reduced, but it’s far better than facing fraud charges.

Reporting Changes in Circumstances

Your eligibility for unemployment benefits can change based on various life events. It is your legal and ethical responsibility to report these changes to the unemployment agency as soon as they occur. Examples of changes include:

- Starting a New Job: Even if it’s part-time, you must report the start date and earnings.

- Becoming Unable to Work: If you become ill or injured and are no longer able to work, your eligibility may be affected.

- Moving Out of State: This can impact where and how you receive benefits, as well as your job search requirements.

- Refusing a Suitable Job Offer: Refusing a job offer that is deemed ‘suitable’ can lead to disqualification from benefits.

Transparency and timely reporting are crucial to avoid overpayments and potential penalties.

Consequences of Unemployment Fraud

Unemployment fraud is a serious offense with significant repercussions. The consequences can include:

- Repayment of Benefits: You will be required to pay back all fraudulently obtained benefits, often with interest.

- Penalties: States can impose substantial monetary penalties, sometimes up to 150% of the overpaid amount.

- Disqualification from Future Benefits: You may be disqualified from receiving unemployment benefits for a significant period in the future.

- Criminal Charges: In severe cases, unemployment fraud can lead to criminal prosecution, resulting in fines, probation, or even jail time.

It is always in your best interest to be honest and compliant with all unemployment regulations. If you are unsure about what to report or how a situation might affect your benefits, contact your state’s unemployment agency for clarification.

In conclusion, maximizing unemployment benefits in 2025 must always be done within the bounds of legal and ethical conduct. By accurately reporting income and changes in circumstances, and understanding the severe consequences of fraud, claimants can ensure they receive their rightful benefits without jeopardizing their future financial or legal standing.

| Key Aspect | Brief Description |

|---|---|

| State-Specific Rules | Eligibility, amounts, and duration vary significantly by state. Always check your local Department of Labor. |

| Extending Benefits | Explore Extended Benefits (EB) and potential federal programs to secure up to 13 additional weeks. |

| Application Accuracy | Meticulous documentation and truthful reporting are crucial to avoid delays and denials. |

| Job Search Compliance | Actively seek work and document efforts to maintain eligibility and avoid benefit suspension. |

Frequently Asked Questions About Unemployment Benefits in 2025

To find your state’s specific rules, visit your state’s Department of Labor or Workforce Development agency website. These sites provide detailed information on eligibility, weekly benefit amounts, duration, and application procedures, which are crucial for maximizing unemployment benefits in 2025.

Yes, you may be able to extend your benefits through federal-state Extended Benefits (EB) programs, which trigger during periods of high unemployment, or potential future federal extensions. These can add up to 13 additional weeks of coverage, but require active monitoring and reapplication.

If your claim is denied, you have the right to appeal the decision. Carefully review the denial notice to understand the reason, gather all relevant documentation, and file your appeal within the strict deadline provided by your state’s unemployment agency.

Absolutely. Most states offer free reemployment services through their workforce development agencies, including career counseling, resume workshops, job search assistance, and even skill training programs. These resources can significantly aid your job search efforts.

Failing to report income while collecting unemployment can lead to serious consequences, including repayment of overpaid benefits, monetary penalties, disqualification from future benefits, and potentially criminal charges for unemployment fraud. Always report all earnings accurately.

Conclusion

Maximizing unemployment benefits in 2025 is a multifaceted endeavor that demands vigilance, meticulous attention to detail, and a proactive approach. From understanding the intricate state-specific regulations to strategically applying for extensions and adhering to job search requirements, every step plays a crucial role in ensuring you receive the full scope of financial support available to you. By staying informed, maintaining accurate records, and leveraging available resources, individuals can effectively navigate the unemployment system, secure crucial aid, and successfully transition back into the workforce with greater confidence and stability.