2026 Federal Grants for Graduate Studies: Unlock $5,000+ Funding

This insider's guide reveals how graduate students in the US can secure over $5,000 in federal grant funding for 2026, detailing essential programs, eligibility criteria, and strategic application tips.

Optimizing Your 2026 Investment Portfolio: Rebalance for 15% Growth

To achieve a 15% growth target for your 2026 investment portfolio, strategic rebalancing is paramount. This guide provides actionable insights for navigating market shifts and optimizing asset allocation in the evolving US financial landscape.

US labor market trends and unemployment updates you need to know

US labor market trends and unemployment updates are crucial for understanding the economy's current health. Dive in for insights!

Workforce Development Benefits 2026: Grants & Training

In 2026, the US government is significantly expanding federal grants and training programs aimed at boosting employment by 15% through robust workforce development initiatives nationwide.

Career development programs for adults: unlock your potential

Career development programs for adults can reshape your future. Explore options that can enhance your skills and boost your career!

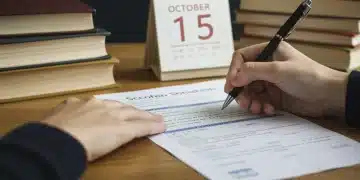

2026 FAFSA Changes: Essential Updates for College Applicants

Navigating the 2026 FAFSA changes is crucial for college applicants seeking financial aid. These essential updates, including new eligibility calculations and a streamlined application process, will significantly impact how students access federal funding for their higher education.