Unlock $10,000 Manufacturing Tax Credits

U.S. small business owners in manufacturing can claim up to $10,000 in federal tax credits by December 2025, offering a significant financial boost for innovation and job creation. This guide details eligibility, application processes, and strategic tips to maximize these valuable incentives.

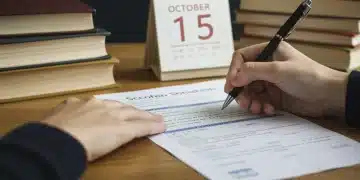

FAFSA Changes: Essential Updates for US College Aid

The 2025 FAFSA introduces significant changes to how US college students qualify for federal financial aid, streamlining the application process and altering eligibility criteria for Pell Grants and other assistance.

Medicare Part B Premium Adjustments: What Beneficiaries Need to Know

Navigating 2025 Medicare changes is crucial for beneficiaries to understand how Part B premium adjustments will impact their healthcare expenses and financial planning.

Federal Budget: 0.7% Increase in Key Sectors Analyzed

The approval of the 2025 federal budget signals a 0.7% increase in allocations for critical sectors, reflecting strategic shifts in national priorities and economic planning. This adjustment aims to bolster specific areas while maintaining overall fiscal prudence.

SEC Regulations Q3 2025: Investor Reporting & Portfolio Adjustments

The SEC is introducing new reporting requirements for Q3 2025, impacting U.S. investors significantly. Understanding these changes is crucial for compliance and making necessary portfolio adjustments to navigate the evolving regulatory landscape effectively.

Apprenticeship Programs US 2025: 3 Key Career Benefits

Apprenticeship programs in the US for 2025 offer significant advantages, providing individuals with practical skills, valuable work experience, and a clear path to stable, well-paying careers without accumulating student loan debt.